Everyone in this world requires money since we all utilise it yet we commonly desire additional funds. But managing money effectively? Now, that’s the real game-changer.Everyone from working specialists to college students who manage their funds will find financial success through learning effective money handling.

Here in this insight, you will understand how to manage your money and be happy at the month-end time. Let’s explore these insights to the end; don’t miss anything because every piece of information will help you to manage your money!

Understanding Money Management

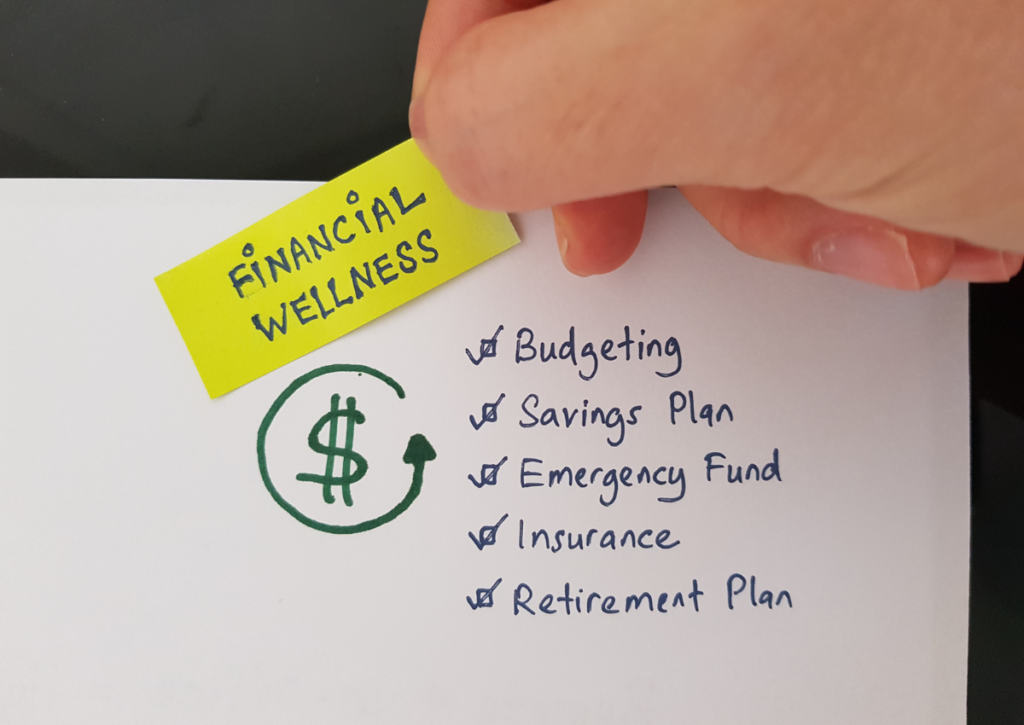

The effective handling of your income together with expenses, savings and investments leads to financial goal achievements. The practice goes beyond tight budgeting since it teaches your money to produce better results. Accurate money management enables you to avoid debt while creating wealth and wealth protection without reducing your present lifestyle quality.

Why Is Money Management Important?

The process of assembling a jigsaw puzzle becomes almost impossible if you cannot consult the image provided on its box. Not having money management skills leads to a confusing situation that causes frustration in life.

Proper money management helps you:

- Mastering financial organization leads to complete awareness about how money moves.

- Het smart decision to avoid debt consists of both avoiding excessive spending and using low-interest loans.

- Financial independence will give you absolute authority to make financial decisions.

- The strategy for future success involves pursuing extended financial goals that include purchasing real estate or starting retirement plans in advance.

Now, real information begins, so read carefully.

Here are the 10 best tips for money management.

1. Educate Yourself

You should take control of your financial development through basic reading of personal finance material. After becoming knowledgeable, you should stop letting other persons divert you from your financial path, including partners pushing expenditure or social connections planning luxurious activities beyond your means. Research financial professionals who include mortgage lenders and accountants before you use their services.

2. Pay With Cash, Not Credit

You should handle your finances with both patience and self-control. Money saved in advance gives you the flexibility to make payments with cash or debit, which directly withdraws funds from your checking before using a credit card. Using a credit card requires paying loan interest because full repayment happens only through complete monthly balance clearance. A good credit score requires credit cards yet these cards should serve exclusively as financial tools for emergency situations.

3. Learn to Budget

You will grasp two fundamental principles after reading several books about personal finance. Your income must always surpass the costs you incur while tracking your monetary movements. The most effective method to follow these money rules includes budgeting and using personal spending plan software to monitor your incoming and outgoing finances.

The process of tracking all expenses, including that daily expensive coffee, creates necessary financial awareness. Your everyday expenses remain in your control for making changes that affect your financial situation. Reducing your monthly rent payment to its minimum value will build wealth and establish you for future homeownership sooner than you would otherwise achieve it.

4. Start an Emergency Fund

Saving money before all other expenses forms the core lesson of personal finance education. This designates funds for future emergencies and personal developments. Performing this financial habit allows you to avoid economic problems while enjoying better nighttime rest. Any person with a minimum budget must contribute to building an emergency fund each month.

You will establish a regular saving routine until saving money transforms from an optional expense to a compulsory budget requirement. Different savings accounts provide compound interest opportunities through high-yield savings and short-term certificates of deposit (CDs) and money market funds.

5. Monitor Your Taxes

Tax responsibilities represent an essential element for each individual because they typically surpass regular expenses by a considerable margin. According to the Income Tax Act, different financial exemptions and deductions exist to help people achieve stability through effective tax planning between personal and business operations.

The initial salary the company presents should undergo a tax calculation to verify its ability to fulfill both your essential expenses and savings targets. Internet tools assist users in revealing their taxed income level.

The Income Tax Act of 1961 determines that the filing of income tax returns applies when certain tax conditions are met for taxpayers. Sole proprietors need to overcome three important difficulties, which involve tax planning along with cash flow management and the handling of complex tax regulations. Grasping these components remains essential because it helps both with tax compliance and with maximizing financial performance.

Before accepting a starting salary from a company, check to see if your take-home pay meets both your monetary requirements and saving targets after federal tax deductions. You can find multiple online tools that calculate your salary amount after taxation.

6. Save for Retirement Now

You need to begin planning your retirement even if you are still in your youth. Through compound interest, you can save in your 20s to enjoy interest accumulation both from your deposited money and accumulated earned interest, thus securing retirement funds.

Business retirement plans offered by organizations serve as excellent pension options. Employees benefit from putting pretax dollars into their accounts, while many companies provide retirement matching that results in additional free company investments.

7. Guard Your Health

Managing money successfully requires you to keep your health safe. Bad health creates expensive medical costs, which decrease saved money and generate significant financial pressure. Long-term diseases demand expensive medical treatments together with medications, which demonstrates why prevention serves as a wiser financial method. The practice of a healthy lifestyle reduces both health-related bills and healthcare surprises.

A healthy state enables people to work steadily, which produces continuous wages. Medical challenges accompanied by absent workdays, decreased income and possible career termination result in damaged financial security. People with better health get to enjoy reduced insurance premium costs, which cut down their expenses on insurance policies for both health and life coverage.

Financial management benefits from how well a person maintains their mental state. Health conditions combined with stress both trigger spontaneous spending habits and bad financial decisions and ill-judged money handling practices. A clear mind leads to better economic decisions that result in careful handling of savings and investments.

The practice of maintaining health while exercising actively, eating properly and scheduling preventive medical checkups will create sustained financial advantages. The investing strategy creates stable income flows, which enables residents to build better retirement plans while needing fewer resources in their advanced years. The smart investment of our health at present guarantees both financial independence and ongoing stability, thus becoming imperative for successful money handling.

8. Minimise Unnecessary Expenses

The biggest financial mistake occurs when people spend their money on unimportant items. Make sure you consider spending purposes carefully since these decisions need to match your essential requirements with your financial targets.

The key to keeping track in your budget lies within disciplined budget planning because social events will create unexpected weekend costs. Regular assessment of your spending habits will let you maintain expenditures that serve your future savings goals.

9. Protect Your Wealth

People who rent their homes should acquire renter’s insurance because it safeguards their belongings from theft and damage by fire. Pay attention to all policy details, which outline covered services as well as excluded benefits. Disability insurance guarantees that unable workers get continuing salary payments whenever illness or severe injuries stop them from performing their job.

To receive objective financial planning advice about money management, find a professional planner who receives fees only. Fee-only financial planning leads to unbiased financial guidance since fee-only planners do not receive payment through specific financial deals they promote.

10. Finding part-time job

Finding paid work between full-time classes represents a strategic solution for students to manage their finances. Working while remaining in full-time college studies presents a difficult challenge but many available part-time jobs let you schedule hours according to your academic requirements.

You can generate supplementary funds while continuing your academic work due to the availability of employment positions that operate remotely. Research extensively to find work that matches your times and budget requirements before eliminating potential opportunities.

Final Thoughts

The ability to handle finances properly becomes one of the essential wisdoms you should develop while still being young. Mentally preparing yourself through education alongside budgeting and early financial choices, we will establish lasting financial security and wealth accumulation. Working on financial steps today through saving, investing and managing costs will ultimately result in freedom from financial limitations in the future.

Still confused? Then read these FAQs

How Do I Choose a Financial Advisor?

When searching for financial planning help, a young person should select a fee-only expert. The sole compensation of fee-only planners consists of fees, while commission-based advisors earn commissions when they switch you to their company investment plans; therefore, fee-only planners remain objective with their advice.

Where should a 17-year-old spend their money?

A 17-year-old should focus on spending their money wisely. It’s important for them to have enough to cover basic expenses like transportation and phone bills, while also setting aside some for social activities and essential purchases. Parents or guardians can help by discussing a plan together to ensure responsible spending.

How should I manage my money at my age of 20s?

Money management in your 20s requires establishing specific financial targets while monitoring costs and developing spending plans. The first step in money management involves automated savings in addition to emergency fund development and debt repayment starting from the higher interest rates first. This set of habits enables financial security and enables you to develop effective plans for your future.

What is the best financial advice in 2025?

Invest in yourself

Plan your spending

Learn how to invest money in a better place.

Make decisions very carefully.

How to Achieve Financial Success in 2025?

To achieve financial success, one needs to handle debt appropriately. Try to avoid borrowing too much and cancel university debts prior to acquiring a house while distinguishing between healthy and harmful debt. Financial success among married couples becomes easier to attain by creating joint financial strategies.

How should I manage my money at my age of 20s?

Money management in your 20s requires establishing specific financial targets while monitoring costs and developing spending plans. The first step in money management involves automated savings in addition to emergency fund development and debt repayment starting from the higher interest rates first. This set of habits enables financial security and enables you to develop effective plans for your

What are the top 3 financial habits in 2025?

The three essential financial habits for stronger money management are a periodic review of your financial plan with updates as well as setting specific monetary targets and developing a budget to direct spending. The three habits direct your financial management while enabling you to make better and wiser decisions.

Don’t wait to implement these financial management strategies now and secure a better future!