PhonePe, one of India’s leading digital payment platforms, is gearing up for its much-anticipated Initial Public Offering (IPO) in 2025. With a strong user base and growing market dominance, the fintech giant is preparing for a significant stock market debut. This article covers key details about PhonePe’s IPO, its financial performance, valuation, and future prospects.

PhonePe IPO: Key Highlights

- IPO Timeline: Expected to launch in 2025

- Target Valuation: Up to $15 billion

- Investment Banks Appointed: Kotak Mahindra Capital, JP Morgan, Citi, and Morgan Stanley

- Revenue Growth: ₹5064 crore in FY24 (73.78% YoY growth)

- Market Position: Dominates 48.4% of India’s UPI transactions

- User Base: Over 590 million registered users

Success Story: PhonePe’s Rise to the Top

PhonePe was founded in 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer with a mission to revolutionize digital payments in India. The startup faced stiff competition from Paytm and Google Pay but differentiated itself with a user-friendly interface, seamless UPI transactions, and strong merchant partnerships. Acquired by Flipkart in 2016, PhonePe gained access to a vast ecosystem, fueling its rapid expansion.

By 2020, PhonePe surpassed Google Pay to become India’s top UPI app, processing billions of transactions monthly. Its introduction of mutual funds, insurance, and lending services further strengthened its position. Despite early challenges, including regulatory hurdles and intense competition, PhonePe emerged as a fintech giant, now preparing for a landmark IPO.

Why is PhonePe Going Public?

1. Expanding Market Share in Digital Payments

PhonePe has established itself as a market leader in India’s fintech sector, processing nearly half of all UPI transactions. With increasing digital adoption, the company aims to capitalize on its strong user base and expand into new financial services like insurance, lending, and stock trading.

2. Strong Financial Performance

PhonePe has shown consistent revenue growth, with a 73.78% increase in FY24. Despite reporting a net loss of ₹1,996 crore, the company has significantly reduced its losses from ₹2,795 crore in FY23. The IPO will provide funds to strengthen its operations and achieve profitability.

3. Strategic Redomiciling to India

In 2022, PhonePe shifted its headquarters from Singapore to India, aligning itself with domestic regulations and making it eligible for a local stock market listing. This move also demonstrates its long-term commitment to the Indian market.

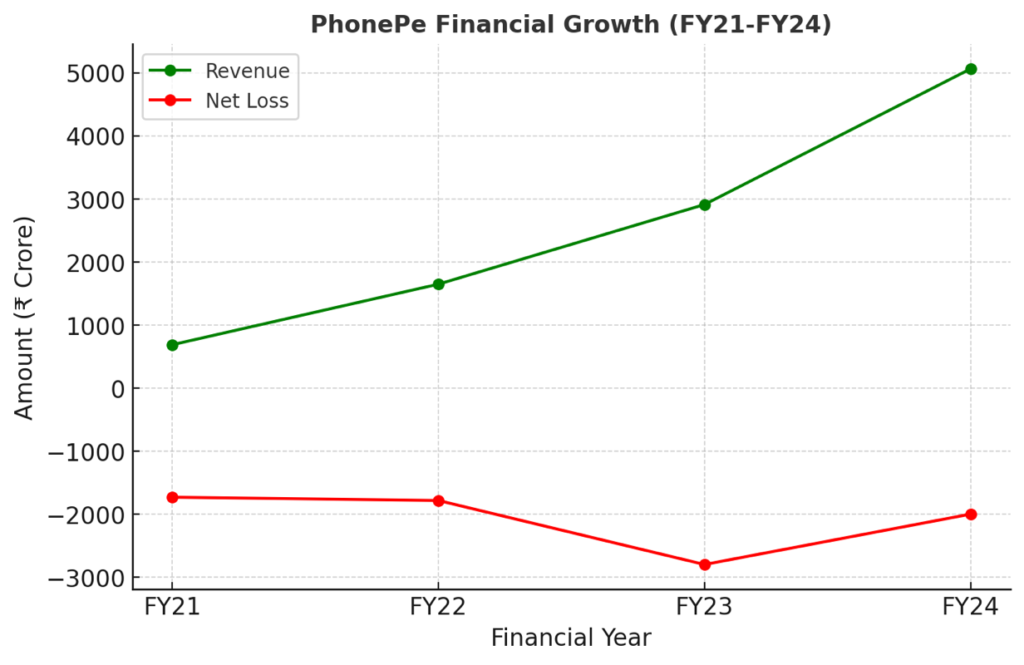

PhonePe’s Financial Growth Chart

Below is a visual representation of PhonePe’s financial growth in recent years:

Here is the financial growth chart for PhonePe, showcasing its revenue and net loss trends from FY21 to FY24.

This visualisation highlights the company’s impressive revenue growth while also demonstrating a reduction in losses, indicating a stronger path toward profitability.

FAQs

What is the expected launch date of PhonePe IPO?

PhonePe’s IPO is expected to launch in 2025. However, the exact date will be announced after regulatory approvals.

What is PhonePe’s valuation for the IPO?

The expected valuation of PhonePe’s IPO is around $12-15 billion.

How does PhonePe make money?

PhonePe earns revenue through merchant transactions, payment gateway fees, advertisements, and financial services like insurance and lending.

Will PhonePe IPO be profitable?

Although PhonePe reported a loss of ₹1,996 crore in FY24, its revenue is growing rapidly. The company aims to turn profitable in the coming years.

How can I invest in PhonePe IPO?

Investors can apply for the IPO through stock brokers or online platforms like Zerodha, Upstox, and Angel One when it opens for subscription.

Final Thoughts

PhonePe’s IPO is set to be one of the most significant fintech listings in India. With a dominant market share in UPI transactions, strong revenue growth, and strategic expansion plans, the company is well-positioned for future success. However, investors should carefully analyse its financial performance and competitive landscape before making investment decisions. If PhonePe continues its trajectory of innovation and market expansion, it could become one of the most valuable fintech companies in the country.